The Auto-Components & Parts Industry: India’s Engine of Manufacturing Growth

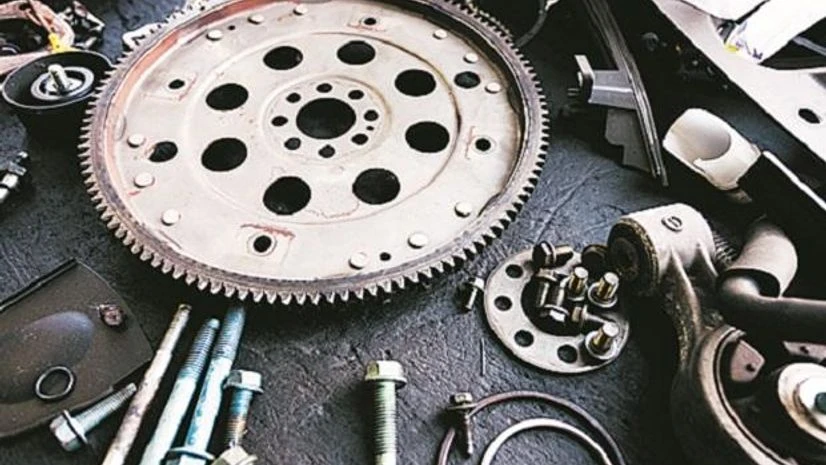

The auto-components industry is one of the most significant pillars of the global automotive ecosystem. It includes every mechanical, electrical, and electronic part that goes into building a vehicle — from engines and transmissions to braking systems, steering assemblies, interiors, and electronics.

In India, the industry has transformed from a small-scale supplier base to a globally competitive manufacturing hub. Today, it plays a crucial role in national industrial growth, employment generation, and export performance.

Historical Background and Establishment

India’s auto-components sector began taking shape in the 1950s, alongside the establishment of the country’s automotive industry. However, significant modernisation and globalisation took place after 1991, when India liberalised its economy.

The Automotive Component Manufacturers Association of India (ACMA) — established in 1959 — played a vital role in organising the sector and setting quality standards. Since then, the industry has witnessed continuous technological advancement, global collaborations, and capacity expansion.

3. Industry Overview

Domestic Market Share: 85% of total output

Export Share: 15% of total output

Employment: 1.5 million+ people directly employed

The sector supplies to Original Equipment Manufacturers (OEMs), Tier-1 suppliers, and the Aftermarket (replacement and repair) segments.

4. Major Categories of Auto-Components and Parts

| Category | Description |

|---|---|

| Engine Components | Crankshafts, camshafts, pistons, valves, cylinder heads, turbochargers. |

| Transmission & Drivetrain | Gearboxes, axles, clutches, propeller shafts, differentials. |

| Suspension & Braking Systems | Shock absorbers, leaf springs, brake discs, brake pads, ABS modules. |

| Steering & Chassis Components | Steering gears, tie rods, wheel hubs, chassis frames. |

| Electrical & Electronic Components | Wiring harnesses, alternators, batteries, sensors, ECUs. |

| Body & Structural Parts | Door panels, bumpers, dashboards, plastic mouldings. |

| Interior & Trim Parts | Seats, carpets, door trims, insulation materials. |

| EV Components (Emerging Segment) | Electric motors, power electronics, battery management systems. |

5. Key Manufacturers, Exports & Establishment Details

| Company Name | Year Established | Major Exports / Focus Areas | Official Website |

|---|---|---|---|

| Samvardhana Motherson International Ltd. (Motherson Group) | 1986 | Wiring harnesses, mirrors, polymer modules; exports to 40+ countries. | motherson.com |

| Bharat Forge Ltd. | 1960 | Forged engine & chassis components; exports to the USA, Germany, and Japan. | bharatforge.com |

| Varroc Engineering Ltd. | 1990 | Exterior lighting systems, electrical modules, and polymer parts; supplies to Ford, VW, Bajaj. | varroc.com |

| Pricol Limited | 1975 | Instrument clusters, oil pumps, sensors, and telematics products; exports to 45+ countries. | pricol.com |

| Rockman Industries Ltd. | 1956 | Aluminium die-cast auto parts, machined components; part of Hero Group. | rockman.in |

| Lumax Industries Ltd. | 1945 | Automotive lighting systems; joint venture with Stanley Electric (Japan). | lumaxworld.in |

| Sundram Fasteners Ltd. | 1966 | Fasteners, engine parts, sintered metal components; strong export base in the USA & Europe. | sundram.com |

| Endurance Technologies Ltd. | 1985 | Suspension, transmission, and braking systems; exports to Europe & ASEAN markets. | endurancegroup.com |

| Gabriel India Ltd. | 1961 | Shock absorbers and suspension products for OEMs and aftermarket. | anandgroupindia.com |

| Bosch India Ltd. | 1987 | Electricals, fuel systems, and mobility solutions; exports to global Bosch network. | bosch.in |

6. Export Performance and Global Reach

India has emerged as a preferred destination for global sourcing of auto components due to its cost competitiveness, skilled workforce, and engineering capabilities.

Top Export Destinations: USA, Germany, UK, Thailand, Italy, Brazil, and Mexico.

Top Export Categories: Drive transmission & steering parts, engine components, suspension & braking, body & chassis, and electronics.

(Source: IBEF Auto-Components Report, ACMA India Report 2024)

7. Growth Drivers and Opportunities

Electric Vehicle Transition: Rising demand for EV-specific parts such as motors, controllers, and battery systems.

Global Supply-Chain Diversification: India benefits from “China + 1” strategies adopted by global OEMs.

Government Support: 100% FDI allowed, Production Linked Incentive (PLI) schemes, and “Make in India” initiatives.

Aftermarket Expansion: Growing vehicle population drives demand for spares, servicing, and replacements.

Digital Manufacturing: Adoption of Industry 4.0 and automation for quality and efficiency improvements.

8. Challenges and Strategic Focus

While opportunities are vast, the industry faces challenges such as:

Volatile raw material and logistics costs.

Need for advanced R&D and global quality standards.

Transition risks from ICE to EV systems.

Skill shortages in high-technology manufacturing.

Strategically, companies must invest in innovation, sustainability, automation, and global partnerships to remain competitive.

9. Future Outlook (2026 and Beyond)

By 2026, the Indian auto-components industry is projected to reach US$100 billion, with exports exceeding US$30 billion.

The sector will increasingly focus on:

EV components and electrification systems.

Smart and connected mobility solutions.

Global design, R&D, and engineering services.

India’s position as a global manufacturing hub will strengthen further, driven by its quality manufacturing, strong OEM linkages, and strategic global partnerships.

10. Conclusion

The auto-components and parts industry stands as the driving engine of India’s industrial transformation. With strong domestic demand, expanding export potential, and a clear shift toward electrification, this sector is set to define the next decade of India’s manufacturing growth.

Post Comment